When Diane Swonk first attended the Federal Reserve’s annual financial convention in Jackson Gap within the late Nineteen Nineties, there was a cheerful hour for girls who attended the occasion. It barely stuffed a single desk.

Now, the “Ladies at Jackson Gap” pleased hour attracts dozens of feminine economists and high-level decision-makers, from the USA and abroad.

“I am simply glad that now there’s a line for the women’ room,” mentioned Swonk, a longtime Fed watcher who’s chief economist for the accounting large KPMG.

It’s not simply at Jackson Gap but additionally within the Fed’s boardroom the place its management has turn out to be its most numerous ever. There are extra feminine, Black and overtly homosexual officers contributing to the central financial institution’s interest-rate selections than at any time in its 109-year historical past. Many are additionally far much less rich than the officers they’ve changed.

Over time, economists say, a wider vary of voices will deepen the Fed’s perspective because it weighs the results of elevating or decreasing charges. It could additionally assist diversify a career that traditionally hasn’t been seen as notably welcoming to girls and minorities.

“Broadly, that is useful,” mentioned William English, a former senior economist on the Fed who teaches on the Yale College of Administration. “There’s proof that numerous teams make higher selections.”

The central financial institution, as it’s doing now, raises its benchmark short-term fee when it desires to decrease inflation, and reduces it when it desires to speed up hiring. Such strikes, in flip, have an effect on borrowing prices all through the financial system — for mortgages, auto loans and enterprise loans, amongst others.

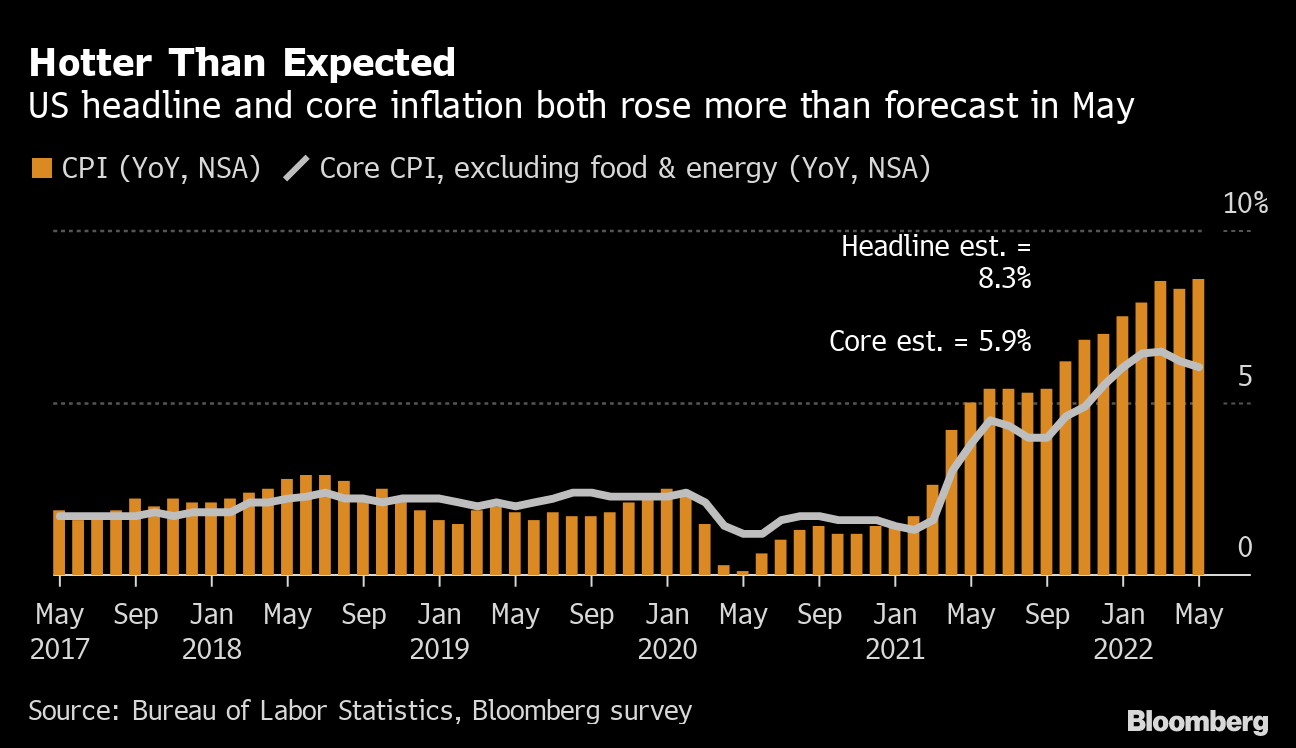

On Friday, in his speech to the Jackson Gap symposium, Chair Jerome Powell confused that the Fed plans additional fee hikes and expects to maintain its benchmark fee excessive till the worst inflation bout in 4 many years eases significantly — even when doing so causes job losses and monetary ache for households and companies.

Rhonda Vonshay Sharpe, an economist who’s president of the Ladies’s Institute for Society, Fairness and Race, mentioned she welcomed the broadening of the Fed’s management. Sharpe mentioned she’s “hopeful {that a} extra numerous group of individuals can pay consideration” to what the Fed does and aspire to high-level financial roles.

Schools and universities, she advised, ought to do extra to encourage and put together college students for financial careers, together with steering extra of them to check arithmetic.

The change on the Fed has been a fast one, with three African People and three girls having joined the central financial institution’s 19-member interest-rate committee simply this yr. (Below the Fed’s rotating system, solely 12 of the 19 committee members vote annually on its fee selections.)

The Fed’s influential seven-member Board of Governors, primarily based in Washington, now consists of two Black economists, Lisa Cook dinner and Philip Jefferson, who have been each nominated by President Joe Biden and have been sworn on this Might. They’re the third and fourth Black individuals on the board. Governors get to vote on each Fed fee determination.

Biden additionally elevated Lael Brainard, a governor since 2014, to the board’s highly effective vice chair place.

As well as, two of the presidents of the Fed’s 12 regional banks at the moment are Black — Raphael Bostic of the Atlanta Fed and Susan Collins of the Boston Fed. Collins, previously provost of the College of Michigan, turned Boston Fed president this yr. Bostic took workplace in 2017.

Simply final week, Lorie Logan, a former senior official on the New York Fed, turned president of the Dallas Fed. 5 of the regional financial institution presidents are girls.

Nela Richardson, chief economist on the payroll processing agency ADP, famous that the schooling and expertise of the brand new policymakers are just like their predecessors, with Cook dinner, Jefferson and Collins all Ph.D. economists — an above-average proportion amongst new Fed officers, she mentioned.

Richardson advised that having extra girls within the Fed’s management is especially necessary now, as a result of most of the issues the central financial institution faces — together with very low unemployment that’s fueling wage will increase and inflation — are associated to girls’s capability to hitch the workforce. Fewer girls, notably moms of younger youngsters, are working now in contrast with pre-pandemic developments.

That shortfall is pushed, partially, by a drop within the variety of childcare employees for the reason that pandemic. With fewer girls working or searching for work, many companies should increase pay to compete for a smaller pool of labor. These larger wages are then usually handed on to shoppers as larger costs, thereby fueling inflation.

Swonk credit Esther George, president of the Kansas Metropolis Fed, for driving change on the Jackson Gap convention by inviting extra girls over time, together with Cook dinner and Collins, to attend and take part in panels. Annually, about 130 influential central bankers and economists collect at Grand Teton Nationwide Park in Jackson Gap on the finish of August to community and talk about the financial system’s challenges.

Even because it has considerably diversified its management, the Fed has but to handle one situation: A Hispanic American has by no means served on the Fed’s rate-setting committee — a continuously voiced grievance of Sen. Robert Menendez, a New Jersey Democrat. For that cause, Menendez voted this yr in opposition to confirming Powell’s reappointment for a second four-year time period as Fed chair.

This yr, Biden additionally named Michael Barr, a former Treasury Division official, as a Fed governor, filling all seven seats on the board for the primary time in practically a decade.

Vincent Reinhart, a former Fed economist who’s now at Dreyfus and Mellon, mentioned it is uncommon for the Fed to have skilled a lot turnover so rapidly. Fed governors serve staggered phrases which can be supposed to end in one emptiness each two years. The regional financial institution presidents have five-year phrases that may be renewed.

“This has obtained to be probably the most dramatic change in Fed management in a single yr on file,” he mentioned.

The brand new members, together with Barr, usually tend to favor decrease charges to help the financial system and hiring, Reinhart mentioned. But for now, with inflation close to a 40-year excessive, the Fed’s policymaking committee is transferring unanimously to sharply increase charges to attempt to cool the financial system and decrease inflation. There’s little signal of any dissent from that strategy, for now.

Tim Duy, chief U.S. economist at SGH Macro, advised that the Fed is in contrast to the Supreme Courtroom in a single necessary respect: Simply because a president has nominated a number of new Fed board members would not essentially have an effect on the central financial institution’s policymaking.

The Fed is a extra technocratic establishment, Duy mentioned, “the place you are extra prone to see individuals’s views evolve over time,” in response to altering financial knowledge. At its July assembly, all 12 members of the Fed’s coverage committee voted for a big three-quarter-point fee hike — an unusually massive enhance.

Nonetheless, Reinhart mentioned, if inflation ought to fall considerably and look like below management and if unemployment started to rise because the Fed’s fee hikes squeeze the financial system, a few of Biden’s appointees may begin to argue for an finish to the will increase — and even to chop charges.

The consequence could be much less unanimity across the Fed’s selections, Reinhart mentioned. Or Powell may find yourself suspending fee hikes sooner than he would like, to protect consensus.

“There’s much more alternative for variations of opinion as we get longer into this rate-hiking cycle,” he mentioned.